InsurTech Software Development

Digitally Rewriting the Rules of Insurance: One Line of Code at a TimePresently, where risk is constantly being redefined, insurance can't afford to be slow or outdated. That's where you need us. We at Jconnect help insurers become innovators with InsturTech solutions built for speed and trust.

We don't just build insurance software: we engineer confidence at scale. From traditional insurers changing legacy systems to disruptive startups building the next big thing: our InsurTech solutions are built to deliver impact from day one.

Insurance Is Being Disrupted. We're Helping Lead the Disruption.

Forget what you know about traditional insurance software: Clunky systems. Disjointed workflows. Limited customization. Today's customers expect more. They expect transparency. Instant access. Dynamic policies. Digital Trust.

We at Jconnect develop smart and secure insurance software solutions that not only meet these expectations: they push beyond them.

Our mission?

To turn insurers into tech-first brands: Ready to thrive in a world of digital risk and personalized coverage.

The Future of Insurance Is Digital. And Human.

Insurance isn't just about risk anymore: it's about responsiveness. It's about meeting customers where they are in real time with clarity and trust.

We at Jconnect build InsurTech that does more than digitize: It humanizes. We give insurers the tools to stay compliant and connected to the people they serve.

Building a fully digital insurer from scratch or modernizing a 100-year-old legacy system: We're ready to partner with you on the next chapter of insurance.

Real Results, Not Just Code

We've helped:

A digital-first insurer reduces claim processing time by 42% through smart automation.

A legacy insurer modernized its core systems and improved agent productivity by 60%.

A startup launches a cyber insurance product from concept to MVP in 90 days.

Our InsurTech Software Development Services

We design and develop a wide range of insurance technology products: customized to your business model and customer journey.

Build dynamic and configurable platforms to create and track policies across lines of business: Life. Health. Property. Auto. Cyber & More. Integrated with smart workflows, automation triggers, and document management.

No more paperwork. No more obstructions. We automate: Claims Intake. Validation. Fraud Detection. Settlement. It reduces resolution times and operational costs while enhancing customer trust.

Our AI/ML modes analyze large data sources: From health records to vehicle telematics and deliver smarter and fairer underwriting decisions. Risk is no longer a guess; it's a data-supported insight.

Strengthen policyholders and agents with self-service capabilities. From real-time quote generation to policy renewals and claims status, we create portals that simplify every touchpoint.

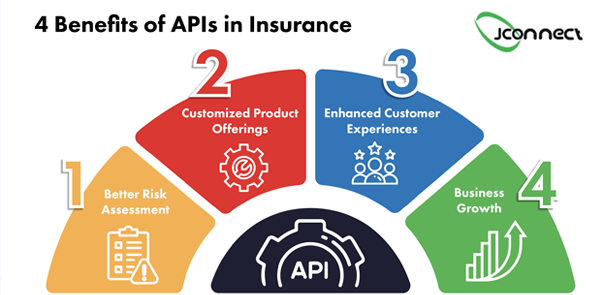

Smoothly connect with: Reinsurers. Brokers. Payment Gateways. CRM Systems. KYC Platforms. Regulatory Databases: through custom APIs and middleware built for speed and security.

Use historical and real-time data to: Forecast customer behavior. Assess risk portfolios. Adjust product offering proactively. We bring clarity to complexity.

Stay ahead of growing compliance requirements (IRDAI, HIPAA, GDPR, NAIC, etc.) with automated reporting and policy governance built right into the system.

We help cyber insurers launch products with: Real-time risk scoring. Breach detection APIs. Dynamic policy management aligned with growing digital threats.

Our Technology Stack

We combine modern technologies to deliver sound and adaptable insurance platforms:

Frontend :

Angular. React. Vue.js. Flutter

Backend :

Java. .NET Core. Node.js. Python

Databases :

PostgreSQL. Oracle. MongoDB. SQL Server.

Cloud & DevOps :

AWS. Azure. GCP. Docker. Kubernetes .

AI/ML :

TensorFlow. OpenAI APIs. Scikit-learn. PyTorch .

Security :

OAuth 2.0. JWT. SSO. Role-Based Access Control (RBAC). Encryption Protocols

APIs & Integrations: Guidewire. Duck Creek. Stripe. Plaid. LexisNexis. Twilio

.

Why Jconnect for Insurance Software Development?

Domain-Driven Engineering

Insurance is complex: we get that. From underwriting to reinsurance. From actuarial models to compliance: Our developers understand the sphere, not just the code.

Design for Humans, Not Just Policies

We build systems that are not just functional, but attractive. Be it a claims adjuster or a first-time policyholder: Our UI/UX approach makes insurance feel easier and faster.

The world is a dangerous place to live; not because of the people who are evil, but because of the people who don't do anything about it.

Intelligence at the Core

We infuse: AI. Machine Learning. Automation into every solution: Making decisions: Smarter. Processes Learner. Experiences Richer.

Built for Trust

Your software requires managing: Sensitive Data. Complex Workflows. Real Money. We deliver: Enterprise-Grade Security. Compliance Adherence. Rock-Solid Architecture.

Scalable & Future-Ready

Our cloud-native solutions grow with your business. Insuring 1,000 people or 10 million? We ensure you're never limited by tech.